About this weblog

Monday, November 16, 2020

Vodafone Reports Slight Recovery

Friday, October 30, 2020

Google Sees Advertising Perk Up

Alphabet reported a 15% year-on-year rise in revenues at constant currency for the third quarter to 46.2 billion US dollars, after reporting flat revenues form the second quarter. Google search and other advertising revenues were 26.3 billion dollars in the quarter, up 6% year-over-year as advertiser spend began to pick up in August. YouTube advertising revenues were 5 billion dollars, up 32% year-on-year, "driven by ongoing substantial growth in direct response, followed by a rebound in brand advertising."

Google Cloud revenues were 3.4 billion dollars for the third quarter, up 45% year-over-year, while "other revenues" were 5.5 billion dollars, up 35% year-over-year, primarily driven by growth in Play and YouTube non-advertising revenues. In its Other Bets division, which includes the self-driving vehicle developer Waymo, revenues in the third quarter were 178 million dollars, while the operating loss was 1.1 billion dollars. Source: Alphabet collateral

Thursday, October 29, 2020

Telefónica Takes Another COVID Hit

Dragged down by the pandemic, Telefónica reported a 4.5% year-on-year fall in revenues to 10.46 billion euros for the third quarter of 2020 on an organic basis. That compares with a 5.6% decline in the second quarter of 2020.

The Madrid-based group estimated that COVID-19 had a negative impact on group revenue of 591 million euros in the third quarter compared with 729 million euros in the second quarter, as handset sales picked up. It said its operations in Spanish-speaking Latin America accounted for 31% of the total impact, followed by Spain with 26%, the UK at 20% and Brazil at 15%. Germany accounted for just 5%. Source: Telefónica statement.

Friday, October 23, 2020

Chinese 5G Demand Lifts Ericsson

Ericsson reported a 7% year-on-year increase in revenues for the third quarter of 2020 on a like-for-like basis to 57.5 billion Swedish krona (6.6 billion U.S. dollars). The rise was mainly driven by sales of 5G network equipment in mainland China, Ericsson said. Overall network revenues rose 13% on a like-for-like basis.

The results reflect "high activity levels in North East Asia and North America," said Börje Ekholm, CEO of Ericsson. "Underlying business fundamentals remain strong in North America driven by consolidation in the U.S. operator market, pending spectrum auctions, and increased demand for 5G. The 5G contracts in mainland China have developed according to plan, contributing positively to profits in Q3 and are expected to improve further. Our business in Europe grew based on several footprint gains. While the pandemic has hurt revenues for several of our customers, and in some cases this has led to a reduction of capex, we have not seen any negative impact on our business, largely due to footprint gains. However, the pandemic negatively impacted our sales in Latin America and Africa." source: Ericsson statement

Thursday, October 22, 2020

Tesla Sees Another Strong Quarter

Tesla reported a 39% year-on-year increase in revenue for the third quarter, thanks to "substantial growth in vehicle deliveries". Providing an update on its self-driving systems, it said: "Our Autopilot team has been focused on a fundamental architectural rewrite of our neural networks and control algorithms. This rewrite will allow the remaining driving features to be released. In October, we sent the first FSD [full-self-driving] software update enabled by the rewrite to a limited number of Early Access Program users City Streets." As it collects data over time, the system will become more robust, Tesla added.

Wednesday, October 21, 2020

Netflix Closes in on 200 Million Members

Netflix forecast that its revenues will rise 20% year-on-year in the fourth quarter of 2020 to 6.57 billion U.S. dollars, following a rise of almost 23% in the third quarter. The rate of growth is markedly slower than a year earlier - revenues rose by over 30% in the second half of 2019. Still, by the end of 2020, Netflix expects to be serving more than 200 million paying members. Source: Netflix statement

Thursday, September 10, 2020

Thursday, August 13, 2020

Deutsche Telekom Almost Flat

Excluding the acquisition of Sprint and adjusted for exchange rate effects, Deutsche Telekom reported a 0.1% rise in revenue for the first half of 2020. The group said revenue was flat in the U.S., rose 1% in Germany and was stable elsewhere in Europe. However, revenue in the Systems Solutions division fell 2.1%

As of mid-July, DT's 5G network, with around 30,000 antennas, covered 40 million people across Germany, the group said, adding that T-Mobile US' 5G network now covers over one million square miles, including 7,500 towns and cities, and 250 million people.

DT also said its LTE network now covers over 98% of all households in Germany, "but ensuring full coverage along transportation routes is proving a challenge for all of the network operators." A total of 850 LTE sites have either been built from scratch or upgraded with LTE antennas since the start of 2020, the operator noted. source: Deutsche Telekom statement

Friday, July 31, 2020

IPad Sales Lift Apple

Apple reported a 11% year-on-year rise in revenue for the quarter ending June 27th to 59.7 billion US dollars. Although iPhone sales grew just 2%, services sales were up 15% and iPad sales leapt 31%. Source: Apple statement

Amazon Sees Extraordinary Growth

Amazon reported a 41% year-on-year increase in sales on a constant currency basis to 88.9 billion US dollars for the second quarter. One year ago the top line was growing at 20%. Sales in North America rose 43%, while sales at Amazon Web Services climbed 29%.

Amazon said it expects sales in the third quarter to grow between 24% and 33% to between 87 billion and 93 billion dollars, after an unfavourable impact of approximately 20 basis points from foreign exchange rates. source: Amazon statement

Thursday, May 21, 2020

Bharti Airtel Reports Remarkable Growth

Cash Cushion for U.S. Telcos

For the big four telcos in the U.S., net cash from operating activities has been on an upward march, thanks in part to tax reforms. The operations of America’s top four telcos generated 101 billion dollars in 2019, up from 73 billion dollars in 2017 (after tax and interest payments). Although the COVID-19 crisis is hitting some revenue streams, such as roaming, these figures suggest the U.S. telecoms industry will weather the storm quite well.

Over the past four years, AT&T’s operations have generated by far the most cash of the four big telcos, consistently over 35 billion dollars each year, while Verizon has bounced back strongly on this metric after a weak 2016 and 2017.

Historically, T-Mobile US, which has just merged with Sprint, has struggled to generate large amounts of cash, primarily because it has used low prices to win market share gains. Still, T-Mobile US generated almost 7 billion dollars from its operations in 2019, up from less than 4 billion dollars in 2018. In the first quarter of 2020, this metric was up 16% year-on-year to 1.6 billion dollars.

Pringle Media has just published a 50 page report tracking and comparing the key financial metrics of the four big U.S. telcos over the past five years: Screen shots of eight sample pages below.

If you would like to purchase a PDF copy of the report, priced at $100 for a company-wide license, please send an email to pringled@btinternet.com

Tuesday, May 19, 2020

U.S. Telcos Keep Capex in Check

America’s top four telcos are collectively investing significantly more in property, plant and equipment ($48 billion in 2019) than they were in 2010 ($42 billion). But the aggregate capital intensity (excluding spectrum licenses) of the big four is now hovering around 12.5% - much lower than in Europe where the big telcos invest about 17% of revenues.

Since 2017, the collective capital intensity of the U.S. telcos has been slipping, as AT&T has bet big on the entertainment sector. Verizon is now putting pressure on AT&T by upping its capital spending as it vies for supremacy in 5G.

During the past five years, Sprint (now part of T-Mobile US) has been the clear laggard, investing just $20 billion in capex. Even together, T-Mobile US and Sprint are investing just two-thirds of Verizon's capex budget.

Pringle Media has just published a 50 page report tracking and comparing the key financial metrics of the four big U.S. telcos over the past five years: Screen shots of eight sample pages below.

If you would like to purchase a PDF copy of the report, priced at $100 for a company-wide license, please send an email to pringled@btinternet.com

Thursday, May 14, 2020

Germany Steps Up as U.S. Slows Down

In Germany, DT's revenue rose 0.9%, while in the rest of Europe growth was 0.4%. With 83,000 new broadband customers, DT said the first quarter marked its best result in two years in Germany. It also attracted 60,000 new users to its MagentaTV service.

Still, DT expects the pandemic to have "limited impact on revenue, due to, for example, the closure of shops, lower roaming revenues, and companies postponing or canceling IT projects. On the other hand, voice telephony revenue is increasing, for instance, and the mobile churn rate is falling." The Group confirmed its guidance for the current financial year.

In the first three months of 2020, DT added 208 new LTE cell sites to its network in Germany, while 534 cell sites have been upgraded with additional LTE antennas. It is aiming to bring 5G to at least 20 of the largest German cities by the end of 2020. DT also said that more than 200 million people in over 5,000 towns, cities, and municipalities across the United States are now reached by T‑Mobile's 5G network. Source: DT statements

Tuesday, May 12, 2020

Vodafone's Performance Picks Up

The company said: "The economic impact of the COVID-19 pandemic in our markets, whilst uncertain, is likely to be significant. Whilst our business model is more resilient than many others, we are not immune to the challenges. We are experiencing a direct impact on our roaming revenues from lower international travel and we also expect economic pressures to impact our customer revenues over time. However, we are also seeing significant increases in data volumes and further improvements in loyalty, as our customers place greater value on the quality, speed and reliability of our networks." Source: Vodafone statement

With the release of Vodafone's annual results, Pringle Media has been able to update the report on the performance of Europe's big five telcos over the past decade. More here.

Europe's Top Telcos Stage Recovery

Note, the Vodafone figures for the fourth quarter of 2019 have now been updated, as the company has now reported on that period.

If you would like to purchase a PDF copy of the report, priced at 100 euros for a company-wide license, please send an email to pringled@btinternet.com

Friday, May 1, 2020

Orange Reports Robust Results Despite Crisis

Orange Group reported a 1% year-on-year rise in revenues for the first quarter to 10.4 billion euros on a like-for-like basis. Revenues in Africa and Middle East grew by 6.2%, and in France by 0.5%. Enterprise revenues grew by 0.8% and Europe by 0.3%. Spain revenues declined by 2.4%.

The Paris-based group said: "Based on currently available information, Orange does not expect a significant deviation from its financial objectives for the fiscal year 2020, but will closely monitor developments."

Stéphane Richard, CEO of the Orange Group, added: “The importance of telecoms in this crisis in ensuring the continued functioning of the economy and of our societies confirms the strategic nature of our activities and provides further confirmation for our strategy in very high-speed networks. Our fibre deployment continues to accelerate with close to 40 million households now connectable to the fibre optic network, underpinning our strong commercial performance. In this quarter the number of fibre customers reached 7.8 million, up 20%." source: Orange statements

Thursday, April 30, 2020

Alphabet Sees Advertising Fall Away

Google Search and other advertising revenues amounted to 24.5 billion dollars, up 9% year-over-year, for the quarter. "This reflects strong year-on-year growth for the first two months of the quarter," Alphabet said. "In March, revenues began to decline and ended the month at a mid-teens percentage decline in year-on-year revenues."

YouTube advertising revenues were up 33% to 4 billion dollars, while Google Cloud, including GCP and G Suite, reported a 52% rise in revenues to 2.8 billion dollars. "Other Revenues" were 4.4 billion dollars, up 23% year-over-year, primarily driven by growth in YouTube subscriptions and sales through the Google Play app store. Alphabet said there are now more than 2.5 billion monthly active Play devices worldwide.

Alphabet also said its video conferencing platform Meet is now adding roughly 3 million new users each day, and has seen a thirty fold increase in usage since January. There are now over 100 million daily Meet meeting participants, it added. Source: Alphabet statements

Monday, April 27, 2020

Europe's Telcos Grapple with Capex Conundrum

Over the past decade, Deutsche Telekom has been the biggest spender, investing over 100 billion euros in plant, property and equipment. However, Telecom Italia leads in terms of capital intensity: It spent an extraordinary one quarter of its revenues on capex in 2015, 2016 and 2017, before scaling back to 22% in 2018 and 21% in 2019.

Pringle Media has just published a 60 page report tracking and comparing the key financial metrics of these five major telcos over the past decade: Screen shots of eight sample pages below.

Note, some of the Vodafone figures for the fourth quarter of 2019 are estimates, as the company hasn't reported for that period yet.

If you would like to purchase a PDF copy of the report, priced at 100 euros for a company-wide license, please email: pringled@btinternet.com.

Saturday, April 25, 2020

Verizon Reports Lockdown Traffic Surge

Verizon reported a 1.6% year-on-year decline in revenue for the first quarter to 31.6 billion US dollars, as wireless equipment revenue fell almost 19% amid the Covid-19 lockdown.

The US telco reported capital expenditures for the quarter of 5.3 billion dollars "to support the capacity for unprecedented traffic growth across Verizon's networks and the deployment of fiber and additional cell sites to support the company's 5G Ultra Wideband rollout." source: Verizon statement

Thursday, April 23, 2020

AT&T Takes Big Entertainment Hit

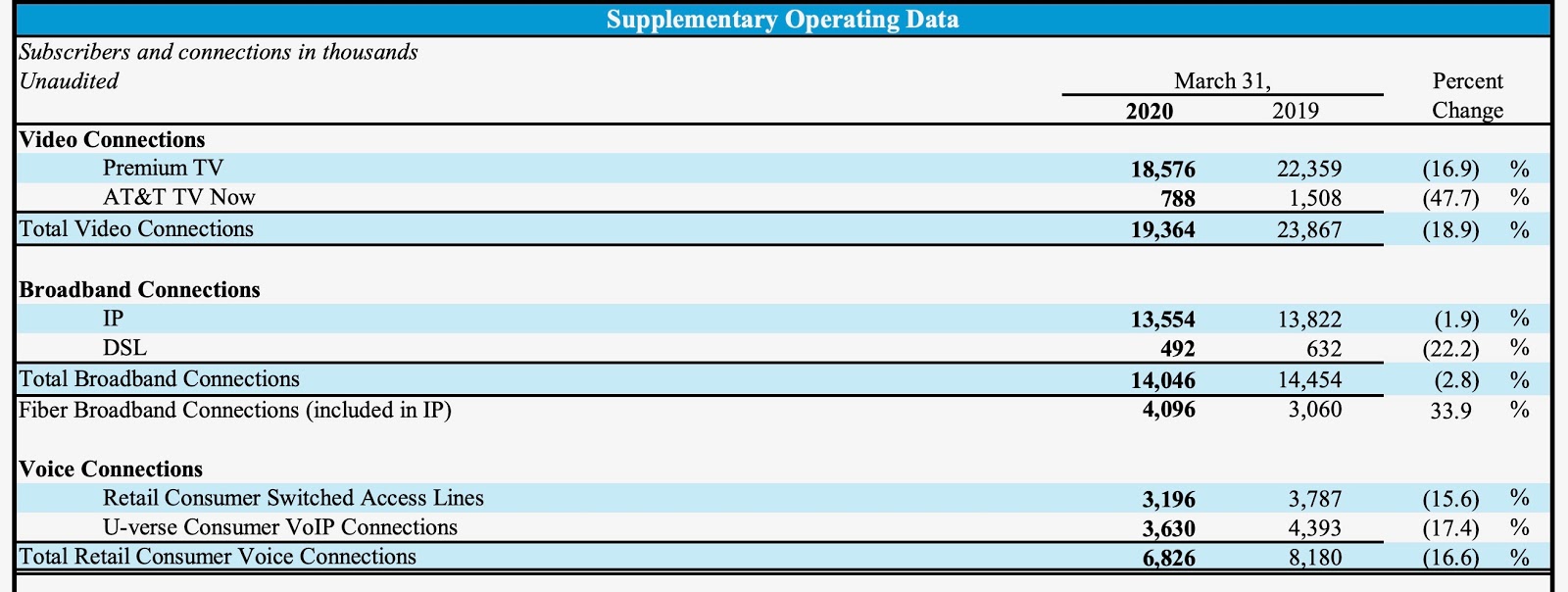

In the telco's communications division, revenues fell 2.6% to 34.2 billion dollars due to declines in the entertainment group, wireless equipment and business wireline that were partially offset by gains in wireless service revenues. In the first quarter, premium TV subscribers (which includes DirecTV, U-verse and AT&T TV subscribers) fell by 897,000 "due to competition and customers rolling off promotional discounts as well as lower gross adds from the continued focus on adding higher-value customers." The video-on-demand service AT&T TV NOW saw a net loss of 138,000 subscribers due to higher prices and less promotional activity. AT&T is planning to launch HBO Max at the end of May.

In the Warner Media division, revenue was down 12.2% to 7.4 billion dollars, while revenues from Latin America fell 7.5% to 1.6 billion dollars as foreign exchange pressures more than offset growth in Mexico. Source: AT&T statement

Wednesday, April 22, 2020

Netflix Pauses Most of its Productions

"Like other home entertainment services, we’re seeing temporarily higher viewing and increased membership growth," Netflix said. "In our case, this is offset by a sharply stronger US dollar, depressing our international revenue, resulting in revenue-as-forecast. We expect viewing to decline and membership growth to decelerate as home confinement ends, which we hope is soon."

Netflix said it has paused most of its productions across the world in response to government lockdowns and guidance from local public health officials. "No one knows how long it will be until we can safely restart physical production in various countries, and, once we can, what international travel will be possible, and how negotiations for various resources (e.g., talent, stages, and post-production) will play out," it added. Source: Netflix statement

North America Bolsters Ericsson

"Underlying business fundamentals remain strong," said Börje Ekholm, Ericsson CEO. "With growth in data in general and with working from home as the new normal in many countries, good connectivity is more important than ever. For 2020, we estimate the RAN (radio access network) market to grow by 4%, however, for Q2 we expect somewhat lower than normal sequential sales growth, as there are uncertainties impacting short-term growth negatively. ...while we have seen no material effects so far on our demand situation, it is prudent to believe that the slowdown in the general economy may lead some operators to delay investment programmes." Source: Ericsson statement.

Tuesday, April 21, 2020

Monday, April 20, 2020

The Broadband Decade: Who Won?

If you would like to purchase a PDF copy of the report, priced at 100 euros for a company-wide license, please send an email to pringled@btinternet.com

IDC: Telecoms Spending to be Flat in 2020

Although the Covid-19 pandemic has increased home usage of telecom services, IDC warned this doesn't directly translate into a surge in telecom spending as many households have unlimited voice calls and unlimited Internet services. "COVID-19 is leading to a lot of uncertainty around the spending impact on various technology markets. We expect the telecom services market to weather the current conditions better than other elements of the ICT market," said Carrie MacGillivray of IDC. Source: IDC statement

Tuesday, April 7, 2020

Samsung Sees Sales Rising

Wednesday, March 25, 2020

Messaging and Calls Soar For Facebook

However, the company added: "We don’t monetise many of the services where we’re seeing increased engagement, and we’ve seen a weakening in our ads business in countries taking aggressive actions to reduce the spread of Covid-19." Source: Facebook statement

Wednesday, February 19, 2020

Deutsche Telekom Forecasts Growth Ahead

Monday, February 17, 2020

Postpaid Mobile Lifts América Móvil

Thursday, February 13, 2020

Orange Buoyed By Cloud and Security

Orange reported a 1.1% year-on-year rise in revenues for the fourth quarter of 2019 on a comparable basis to 11.1 billion euros. Across 2019, revenue rose 0.6% boosted by "very strong momentum in Africa and the Middle East", a "solid performance in Europe and the return of growth in enterprise." Orange said these factors "more than compensated for a very slight decline in France of 0.3% and a decline in Spain of 1.5% in 2019 due to that market's shift towards low cost."

Orange also reported that IT and systems integration activities' share of enterprise revenues climbed two percentage points to reach 37.2% in 2019. "This increase reflects the performance of cloud and cybersecurity services, where Orange has become a European leader thanks to the acquisitions of SecureData and SecureLink," the operator said.

At the end of 2019, Orange Bank had over 500,000 customers, including 390,000 account holders in France. It has also been launched in Spain. Meanwhile, the video-on-demand service OCS Go now has 3.1 million customers. source: Orange collateral

Friday, February 7, 2020

Vodafone Meets Demand for Unlimited Data

Vodafone said it is now offering "new speed-tiered unlimited mobile data plans" in the seven markets where it has launched 5G. "We reached an unlimited consumer customer base of 3 million SIMs" at the end of the quarter, Vodafone reported, adding: "Reflecting the success of our unlimited plans, data volumes on our mobile networks continued to grow strongly in Europe in [the quarter], rising by 45%. Average smartphone usage for our overall customer base increased to 4.5 GB/month (+1.2 GB year-on-year)."

Vodafone also said its new agreement with Amazon Web Services (AWS) to deploy AWS Wavelength solutions at the edge of Vodafone's 5G networks, will deliver a 5-10 times reduction in latency. "The new services will help support artificial intelligence, augmented and virtual reality, video analytics, autonomous vehicles, robotics and drone control, and will generate incremental revenues for the Group," it added. source: Vodafone statement

Tuesday, February 4, 2020

Alphabet Talks Up YouTube and Cloud

Alphabet, the owner of Google, reported a 19% year-on-year increase in revenues to 46.1 billion U.S. dollars for the fourth quarter on a constant currency basis. "At our scale, we are pleased with our rate of growth for 2019 and see ample opportunity going forward,' said Ruth Porat, CFO. "With respect to YouTube advertising, at a year-on-year growth rate of more than 30% in the fourth quarter, we're pleased with the ongoing strength and opportunity at YouTube. We see substantial continuing opportunity in direct response as well as with brand advertisers... the non-advertising services at YouTube, mainly from subscriptions, reached a 3 billion dollars revenue run rate in the fourth quarter."

Alphabet said that Waymo's (self-driving) cars have driven 20 million miles across more than 25 U.S. cities. "Waymo is now serving over 1,500 monthly active riders in Metro Phoenix and continues scaling fully driverless by matching early riders with driverless vehicles and charging for these rides. As Waymo looks to its evolution as a business, it's focusing on strategic partnerships. For example, it's working closely with OEMs and other businesses to build out ride hailing and delivery business lines."

Alphabet also reported that it added as many buildings to Google Maps using machine learning in 2019 as it had using all other techniques in the previous decade. "The Google Assistant now helps more than 500 million monthly users across 90 countries get things done across smart speakers and smart displays, phones, TVs, cars and more," Porat added. "I'm proud to announce that over 80 billion dollars has been earned by developers around the world from Google Play showing the popularity of our platform. There are now over 2 billion active monthly users of Google Play." Source: Alphabet investor documentation

Friday, January 31, 2020

Amazon Saw Slight Slowdown in Fourth Quarter

“More people joined Prime this quarter than ever before, and we now have over 150 million paid Prime members around the world,” said Jeff Bezos, Amazon CEO. "The number of items delivered to U.S. customers with Prime’s free one-day and same-day delivery more than quadrupled this quarter compared to last year... Prime members watched double the hours of original movies and TV shows on Prime Video this quarter compared to last year.” source: Amazon statement

Tesla Says Revenue Growth Will Accelerate

"We are positioned to accelerate our revenue growth further through increasing build rates in Gigafactory Shanghai and our Model Y production line in Fremont. These production increases will allow for higher total vehicle deliveries and associated revenue."

Tesla said its customers vehicles have now driven over three billion miles in "Autopilot mode", adding more data to the neural net it is using to develop self-driving capabilities. "All Tesla vehicles with our FSD computer have been updated with new software that can better detect new details in their environments, allowing us to show various lane markings, traffic lights, stop signs, cones as well as other vehicles and road users. Understanding the environment around a Tesla is key to enabling our cars to react to traffic lights and stop signs and take intersections through city streets. We are currently validating this functionality before releasing to customers, and we look forward to its gradual deployment."

In the fourth quarter, Tesla launched premium vehicle connectivity in the US for 10 dollars (plus tax) per month, which customers can use to stream music or videos, browse the Internet or see live traffic through an embedded connection. Source: Tesla statement

Wednesday, January 29, 2020

Apple Flags Strong Growth Ahead

For the quarter ending December 28, 2019, Apple posted quarterly revenue of 91.8 billion US dollars, an increase of 9% from the year-ago quarter. International sales accounted for 61% of the quarter’s revenue. Revenue from iPhones rose 8%, while revenue from wearables, home and accessories climbed 37%.

Tim Cook, Apple’s CEO, said: “During the holiday quarter our active installed base of devices grew in each of our geographic segments and has now reached over 1.5 billion." Source: Apple statement

Tuesday, January 28, 2020

Ericsson Claims 5G Leadership

Börje Ekholm, CEO of Ericsson, said: "We have regained technology leadership, recovered previously lost ground in several markets... we are a leader in 5G with 78 commercial 5G agreements with unique operators and 24 live 5G networks on four continents. .... Due to the uncertainty related to an announced operator merger, we saw a slowdown in our North American business in the fourth quarter, resulting in North America having the lowest share of total sales for some time. However, the underlying business fundamentals in North America remain strong. .. It is still too early to assess possible volumes and price levels for the expected deployment of 5G in China, and we expect that the initial challenging margins will shift to positive margins over the lifespan of the contracts." source: Ericsson statement

Friday, January 24, 2020

Netflix Fends Off New Competition

Netflix said: "We generated Q4-record paid net adds in each of the EMEA, LATAM and APAC regions, while UCAN (United States and Canada) paid net adds totalled 550,000 (with 420,000 in the U.S.) versus 1.75 million in the year ago quarter. Our low membership growth in UCAN is probably due to our recent price changes and to U.S. competitive launches. We have seen more muted impact from competitive launches outside the U.S.." source: Netflix statement

Saturday, January 4, 2020

Tesla Steps Up Production and Deliveries

The new Model 3 accounted for 83% of the vehicles it produced. Tesla also said its new Shanghai factory, which broke ground less than a year ago, has already produced almost "1,000 customer salable cars." Source: Tesla statement