Source: Netflix statement

About this weblog

What you need to know: This weblog captures key data points about the global telecoms industry. I use it as an electronic notebook to support my work for Pringle Media.

Monday, December 23, 2019

Friday, November 15, 2019

Africa Lifts Airtel

Bharti Airtel reported a 7% year-on-year rise in revenues on a comparable basis for the quarter ending September 30th to 211.3 billion Indian rupees (almost 3 billion US dollars). Its customer base declined 8% to 411 million, due to a 13% fall in India where Airtel is seeing intense competition. Still, revenues in India were up 3% to 153.6 billion rupees, while sales in Africa rose 13% to 853 million U.S. dollars.

In Africa, Airtel said the total customer base using the Airtel Money platform increased by almost 20% to 15.5 million. The total value of transactions on the Airtel money platform rose 35% year-on-year to 7.98 billion dollars in the quarter. Airtel Money revenue for the quarter was 79.3 million dollars, up 51%. Source: Airtel statement

In Africa, Airtel said the total customer base using the Airtel Money platform increased by almost 20% to 15.5 million. The total value of transactions on the Airtel money platform rose 35% year-on-year to 7.98 billion dollars in the quarter. Airtel Money revenue for the quarter was 79.3 million dollars, up 51%. Source: Airtel statement

Tuesday, November 12, 2019

Vodafone Sees Slight Growth

Vodafone said its group organic service revenue increased 0.7% year-on-year in the three months to September 30, driven by "market share gains in Europe Consumer Fixed, continued growth in Vodafone Business, and strong mobile data demand and customer base growth in Emerging Consumer, partly offset by declines in Europe Consumer Mobile."

Vodafone said it is now Europe’s largest owner of "gigabit-capable next generation network (NGN) infrastructure" following the closure of the Liberty Global acquisition, which added 17 million cable homes in Germany and central and eastern Europe to its footprint, increasing the number of homes connected by its NGN network in Europe to 54 million.

Vodafone is upgrading its cable infrastructure using DOCSIS 3.1 technology, and aims to market gigabit broadband speeds to around 50 million households in its cable and FTTH (fibre) footprint by March 2023, compared to 24 million today. It has also launched 5G in seven European markets, with services available in 58 cities with "observed speeds of up to 1Gbps." source: Vodafone statement

Vodafone said it is now Europe’s largest owner of "gigabit-capable next generation network (NGN) infrastructure" following the closure of the Liberty Global acquisition, which added 17 million cable homes in Germany and central and eastern Europe to its footprint, increasing the number of homes connected by its NGN network in Europe to 54 million.

Vodafone is upgrading its cable infrastructure using DOCSIS 3.1 technology, and aims to market gigabit broadband speeds to around 50 million households in its cable and FTTH (fibre) footprint by March 2023, compared to 24 million today. It has also launched 5G in seven European markets, with services available in 58 cities with "observed speeds of up to 1Gbps." source: Vodafone statement

Thursday, November 7, 2019

Top Line Ticks Upwards for Deutsche Telekom

Deutsche Telekom reported a 1.7% year-on-year increase in revenue in organic terms for the third quarter to 20 billion euros. The growth was again fuelled by the U.S. division, which lifted revenues by 3.6% in dollar terms. In Germany, revenues rose 0.6% driven primarily by growth in mobile services and rising demand for fast fixed-line broadband. The group also said its smart home subscriptions rose 25% to 411,000, while subs for its StreamOn proposition (its zero-rated video streaming package for mobile users) climbed 79% to 2.8 million and Magenta TV subs rose 8% to 3.5 million. Source: DT presentation

Tuesday, November 5, 2019

New Services Boost Telefónica

Telefónica reported a 3.4% year-on-year increase in revenues for the third quarter on an organic basis to 11.9 billion euros, propelled by growth in the UK and Latin America.

The group said that "video revenues" rose 6.9% to 757 million euros in the quarter, supported by an increase in subscriptions to its pay TV service and its OTT “Movistar Play” service in Latin America (the latter grew 86% in terms of subs). Telefónica also reported a 24% rise in cloud revenues to 176 million euros, and a 33% increase in IoT revenues to 130 million euros. It now serves 22.4 million IoT connections (up 1.1 million in the quarter). Security revenues rose almost 42% to 128 million euros.

The group’s own fibre/cable network now passes 54.5 million homes, up 11% year-on-year, with 22.7 million of those in Spain. Actual retail fibre/cable connections total 14.2 million (a rise of 11% year-on-year).

The group said: "Investment in fibre is key for Telefónica and will allow the generation of revenues and efficiencies with the capture of savings due to the dismantling of copper networks. The technological evolution of the fibre throughout its useful life of more than 30 years, will allow offering up to 10 Gbps symmetrical and optimise the deployment of 5G. In parallel, the new access network “Open Access” will support increasingly flexible and virtually controlled services." source: Telefónica statement.

The group said that "video revenues" rose 6.9% to 757 million euros in the quarter, supported by an increase in subscriptions to its pay TV service and its OTT “Movistar Play” service in Latin America (the latter grew 86% in terms of subs). Telefónica also reported a 24% rise in cloud revenues to 176 million euros, and a 33% increase in IoT revenues to 130 million euros. It now serves 22.4 million IoT connections (up 1.1 million in the quarter). Security revenues rose almost 42% to 128 million euros.

The group’s own fibre/cable network now passes 54.5 million homes, up 11% year-on-year, with 22.7 million of those in Spain. Actual retail fibre/cable connections total 14.2 million (a rise of 11% year-on-year).

The group said: "Investment in fibre is key for Telefónica and will allow the generation of revenues and efficiencies with the capture of savings due to the dismantling of copper networks. The technological evolution of the fibre throughout its useful life of more than 30 years, will allow offering up to 10 Gbps symmetrical and optimise the deployment of 5G. In parallel, the new access network “Open Access” will support increasingly flexible and virtually controlled services." source: Telefónica statement.

Friday, November 1, 2019

Turkcell See Double Digit Growth

Turkcell reported a 14% year-on-year rise in revenues for the third quarter to 6.6 billion Turkish lira (1.16 billion US dollars). Source: Turkcell presentation

Thursday, October 31, 2019

Apple Calls Out Performance of Apple Pay

Apple reported a 3% year-on-year increase in revenue to 64 billion U.S. dollars for the quarter ending September 28, in constant currencies. It said iPhone revenue was 33.4 billion dollars, a year-over-year decline of 9%.

Revenue in Apple's Services division rose 18% to 12.5 billion dollars. Apple said it now has 450 million paid subscriptions across its services portfolio, compared to 330 million a year ago. For Apple Pay, revenue and transactions more than doubled year-over-year to more than three billion transactions in the September quarter, exceeding PayPal's number of transactions and growing four times as fast, Apple said. Apple Pay is now live in 49 markets around the world and there are 6,000 card issuers on the platform.

Apple expects to report revenue of between 85.5 billion and 89.5 billion dollars for the current quarter, compared with 84.3 billion dollars last year. It said the forecast includes a negative impact from foreign exchange of over 1 billion dollars. Source: transcript of Apple's earnings call from The Motley Fool.

Revenue in Apple's Services division rose 18% to 12.5 billion dollars. Apple said it now has 450 million paid subscriptions across its services portfolio, compared to 330 million a year ago. For Apple Pay, revenue and transactions more than doubled year-over-year to more than three billion transactions in the September quarter, exceeding PayPal's number of transactions and growing four times as fast, Apple said. Apple Pay is now live in 49 markets around the world and there are 6,000 card issuers on the platform.

Apple expects to report revenue of between 85.5 billion and 89.5 billion dollars for the current quarter, compared with 84.3 billion dollars last year. It said the forecast includes a negative impact from foreign exchange of over 1 billion dollars. Source: transcript of Apple's earnings call from The Motley Fool.

Wednesday, October 30, 2019

Demand from Enterprises and Africa Boosts Orange

Orange reported a 0.8% year-on-year rise in revenues to 10.6 billion euros on a comparable basis for the third quarter of 2019. The telecoms group said the increase was driven by 7.6% growth in Africa and the Middle East, a solid performance by its smaller European operations (up 1.4%) and by enterprise revenue growth of 1.8%. Taken together, this more than offset a slight erosion in France of -0.4%, and a more pronounced decline in Spain of -2.5%, "due to a general market move towards the middle and low segments."

Stéphane Richard, CEO of the Orange Group, said: “These results further attest to the relevance of our very high-speed broadband network strategy. In fixed, the strong commercial momentum achieved in fibre, supported by our investments, is clear: we reached more than seven million fibre customers in Europe this quarter, an increase of 25% compared to last year. This can be seen in France in particular where we achieved 178,000 net additions, a record figure for a third quarter. The launch of the Livebox 5 at the beginning of October should also maintain this momentum." source: Orange statement

Stéphane Richard, CEO of the Orange Group, said: “These results further attest to the relevance of our very high-speed broadband network strategy. In fixed, the strong commercial momentum achieved in fibre, supported by our investments, is clear: we reached more than seven million fibre customers in Europe this quarter, an increase of 25% compared to last year. This can be seen in France in particular where we achieved 178,000 net additions, a record figure for a third quarter. The launch of the Livebox 5 at the beginning of October should also maintain this momentum." source: Orange statement

HBO Max Takes Shape

In May 2020, AT&T's WarnerMedia division plans to launch the new video-on-demand service, HBO Max, in the U.S. at a price of 14.99 dollars a month. The company said it is "targeting 50 million domestic subscribers and 75 to 90 million premium subscribers by year-end in 2025 across the U.S., Latin America and Europe."

At launch, AT&T will offer HBO Max to the roughly 10 million HBO subscribers on AT&T distribution platforms, at no additional charge. HBO Now direct-billed users who subscribe directly through HBONow.com will also have access to HBO Max. AT&T customers on premium video, mobile and broadband services will be offered bundles with HBO Max included at no additional charge.

AT&T said HBO Max will launch with 10,000 hours of curated premium content including the entire HBO service, bundled with new "HBO Max Originals" that expand the breadth of the offering targeted at young adults, kids and families. HBO Max will also pull from WarnerMedia’s 100-year content collection, including library content from Warner Bros., New Line, DC, CNN, TNT, TBS, truTV, Turner Classic Movies, Cartoon Network and Looney Tunes, while offering third party series and movies.

Within the first year of launch, WarnerMedia plans to expand the service to include an advertising-supported option. The company also intends to provide subscribers with "unique live, interactive and special event programming" in the future.

AT&T says it will make an incremental investment of between 1.5 billion and 2 billion US dollars during 2020 in HBO Max. That investment includes spending on new content, foregone licensing revenue of content, operating expenses for the technology platform, and marketing. Source: AT&T press release

At launch, AT&T will offer HBO Max to the roughly 10 million HBO subscribers on AT&T distribution platforms, at no additional charge. HBO Now direct-billed users who subscribe directly through HBONow.com will also have access to HBO Max. AT&T customers on premium video, mobile and broadband services will be offered bundles with HBO Max included at no additional charge.

AT&T said HBO Max will launch with 10,000 hours of curated premium content including the entire HBO service, bundled with new "HBO Max Originals" that expand the breadth of the offering targeted at young adults, kids and families. HBO Max will also pull from WarnerMedia’s 100-year content collection, including library content from Warner Bros., New Line, DC, CNN, TNT, TBS, truTV, Turner Classic Movies, Cartoon Network and Looney Tunes, while offering third party series and movies.

Within the first year of launch, WarnerMedia plans to expand the service to include an advertising-supported option. The company also intends to provide subscribers with "unique live, interactive and special event programming" in the future.

AT&T says it will make an incremental investment of between 1.5 billion and 2 billion US dollars during 2020 in HBO Max. That investment includes spending on new content, foregone licensing revenue of content, operating expenses for the technology platform, and marketing. Source: AT&T press release

Tuesday, October 29, 2019

AT&T Forecasts Low Level Growth

AT&T reported a 2% year-on-year fall in revenues for the third quarter to 44.6 billion US dollars, on a constant currency basis. Declines in revenues from legacy wireline services, WarnerMedia and domestic video, were partially offset by growth in strategic and managed business services, domestic wireless services and IP broadband. AT&T said that HBO revenues were up 10.6% on higher content sales and stable subscription revenues.

AT&T forecast that its group revenues will grow by 1% to 2% per year from 2020 to 2022. It predicted this growth will be driven by "strength in Mobility, increased fiber penetration and WarnerMedia." It expects wireless service revenues to grow by more than 2% per year, as well as enjoying significant incremental growth from HBO Max (its new video-on-demand service) and targeted advertising from Xandr.

With reference to HBO Max, Randall Stephenson, CEO, said: "This is not Netflix, this is not Disney, this is HBO Max, and it's going to have a very unique position in the marketplace.... This is going to be a meaningful business to us over the next four or five years. And we're talking a 50 million subscriber business and I'm really, really enthusiastic about this." He went on to clarify that AT&T forecasts that HBO Max will be able to attract 50 million U.S. subscribers within five years. source: AT&T collateral

Revenues and Costs Rising Fast at Alphabet

Alphabet, owner of Google, reported a 22% year-on-year rise in revenues (in constant currencies) to 40.5 billion US dollars for the third quarter of 2019. The growth was driven by mobile search, YouTube and cloud, Alphabet said. Source: Alphabet statement

Monday, October 28, 2019

Verizon Sees Big Step For 5G Ahead

Verizon reported a 0.9% year-on-year rise in revenues to 32.9 billion US dollars for the third quarter of 2019. It said the growth was primarily driven by higher wireless service revenue, partially offset by lower wireless equipment revenue and declines in legacy wireline revenue, predominantly in the business segment.

In response to an analyst question about 5G, CEO Hans Vestberg, commented: "There's coming a next-generation chipset in the second half of 2020. That's really when we think we're going to have a more massive deployment of [5G]. .... this is just the next step for us to get all the insights, billing, experience for our consumers, so we can really take a big step when it come to the next-generation chipset.

"Basically all phones coming out next year will be 5G capable. So we will have a range of phones coming out next year. There's one brand that we don't know, and we haven't talked about them, and again, they need to talk about when they will have a 5G phone. But all others will basically have their phones coming out. So I feel good about it, the performance has gone up dramatically. I mean if I look at the Galaxy coming out, the Samsung Galaxy, which is one of the first phones where in the beginning, we tune up to 500, 600 megabits per second, which we thought was great. That's doing 2 gig right now constantly in the ultra wideband. So we see also a clear improvement on the software tuning between the network and the handsets." Source: Verizon documentation

In response to an analyst question about 5G, CEO Hans Vestberg, commented: "There's coming a next-generation chipset in the second half of 2020. That's really when we think we're going to have a more massive deployment of [5G]. .... this is just the next step for us to get all the insights, billing, experience for our consumers, so we can really take a big step when it come to the next-generation chipset.

"Basically all phones coming out next year will be 5G capable. So we will have a range of phones coming out next year. There's one brand that we don't know, and we haven't talked about them, and again, they need to talk about when they will have a 5G phone. But all others will basically have their phones coming out. So I feel good about it, the performance has gone up dramatically. I mean if I look at the Galaxy coming out, the Samsung Galaxy, which is one of the first phones where in the beginning, we tune up to 500, 600 megabits per second, which we thought was great. That's doing 2 gig right now constantly in the ultra wideband. So we see also a clear improvement on the software tuning between the network and the handsets." Source: Verizon documentation

Friday, October 25, 2019

Comcast Held Back by Broadcast TV

On a like-for-like basis, Comcast reported flat revenues for the third quarter of 2019 of 26.8 billion US dollars. Revenue in its cable communications division increased 4% year-on-year to 14.6 billion dollars, driven primarily by growth in high-speed internet, business services and wireless revenue. Comcast said high-speed internet revenue rose 9.3%, fuelled by an increase in the number of residential high-speed internet customers and rate adjustments.

Revenue in the NBCUniversal division fell 3.5% to 8.3 billion dollars, following a sharp fall in broadcast television revenue. Excluding the impact of currency movements, revenue at Sky increased 0.9% to 4.6 billion dollars, driven by "higher direct-to-consumer and content revenue, partially offset by lower advertising revenue." Source: Comcast statement

Revenue in the NBCUniversal division fell 3.5% to 8.3 billion dollars, following a sharp fall in broadcast television revenue. Excluding the impact of currency movements, revenue at Sky increased 0.9% to 4.6 billion dollars, driven by "higher direct-to-consumer and content revenue, partially offset by lower advertising revenue." Source: Comcast statement

Amazon Flags Slowdown for Fourth Quarter

Marking an acceleration over previous quarters, Amazon reported a 25% year-on-year increase in sales to almost 70 billion US dollars for the third quarter of 2019 on a constant currency basis. Sales at Amazon Web Services were up 35% to almost 9 billion dollars.

However, Amazon warned that sales for the fourth quarter are likely to be between 80 billion and 86.5 billion dollars, which would represent year-on-year growth of between 11% and 20%. This guidance anticipates an unfavourable impact of approximately 80 basis points from foreign exchange rates, Amazon said. Source: Amazon statement

However, Amazon warned that sales for the fourth quarter are likely to be between 80 billion and 86.5 billion dollars, which would represent year-on-year growth of between 11% and 20%. This guidance anticipates an unfavourable impact of approximately 80 basis points from foreign exchange rates, Amazon said. Source: Amazon statement

Thursday, October 24, 2019

Tesla Ramps Up Model 3 Production

Tesla reported a 8% year-on-year fall in revenues for the third quarter of 2019 to 6.3 billion US dollars, driven by a 12% fall on automotive revenues. It blamed the fall on a decline in the average selling price of its cars as its lower-cost Model 3 becomes a larger part of its product mix, together with a sharp rise in the number of vehicles Tesla is leasing, rather than selling.

"We are positioned to accelerate our growth further through Gigafactory Shanghai, Model Y and also through increasing build rates on our existing production lines," Tesla reported. "These capacity increases will allow for higher total vehicle deliveries and associated revenue."

Tesla said customers have used its new Smart Summon feature, which was launched in the US in September, more than one million times to date. This functionality allows Tesla owners to summon their cars from up to 200 feet in a parking lot or driveway. source: Tesla statement

Wednesday, October 23, 2019

Amazon Posts Big Leap in Brand Value

Apple continues to be the world's leading brand, according to a list of the top 100 most valuable brands published by agency Interbrand. But Amazon saw a much larger rise in brand value (24%) in the year since the last list. There are no telecoms brands in Interbrand's top 100. Source: Interbrand ranking

Friday, October 18, 2019

Netflix Reports Rapid Growth

Netflix reported a 35% year-on-year increase in revenues, on a constant currency basis, for the third quarter of 2019 to 5.2 billion US dollars. The company forecast revenue of 5.4 billion dollars for the fourth quarter, which would represent a year-on-year increase of 30%.

Netflix said it added 6.8 million paying subscribers in the third quarter, while its ARPU (average revenue per user) was up 12% on a constant currency basis. Netflix added that it is spending approximately 10 billion dollars of "P&L spend" on content and approximately 15 billion in cash on content in 2019. Source: Netflix statement

Netflix said it added 6.8 million paying subscribers in the third quarter, while its ARPU (average revenue per user) was up 12% on a constant currency basis. Netflix added that it is spending approximately 10 billion dollars of "P&L spend" on content and approximately 15 billion in cash on content in 2019. Source: Netflix statement

Friday, August 9, 2019

Deutsche Telekom Talks Up Networks

Deutsche Telekom reported a 2.9% year-on-year increase in revenues on an organic basis for the second quarter of 2019 to 19.7 billion euros. T-Mobile USA, which posted a revenue increase of 5.1%, was again the main growth engine, but the German business also managed 1.2% growth.

"The foundation of our strong growth remains our good investments in networks," said Timotheus Höttges, CEO of Deutsche Telekom. "In Germany, we already passed over 22 million homes with super vectoring, speeds up to 250 megabits per second. And we are on track for our 28 million customers or households being approached by year-end....German LTE coverage, close to 98% full year target. Our telco added another 1,400 new sites in the last 12 months. This is on track with our ambitious plans to increase our site footprint by 1/3 by 2021." Source: DT statements and presentations

"The foundation of our strong growth remains our good investments in networks," said Timotheus Höttges, CEO of Deutsche Telekom. "In Germany, we already passed over 22 million homes with super vectoring, speeds up to 250 megabits per second. And we are on track for our 28 million customers or households being approached by year-end....German LTE coverage, close to 98% full year target. Our telco added another 1,400 new sites in the last 12 months. This is on track with our ambitious plans to increase our site footprint by 1/3 by 2021." Source: DT statements and presentations

Friday, July 26, 2019

One Day Delivery Lifts Amazon

|

(2) Includes product sales where customers physically select items in a store. Sales from customers who order goods online for delivery or pickup at our physical stores are included in “Online stores.”

(3) Includes commissions and any related fulfillment and shipping fees, and other third-party seller services.

(4) Includes annual and monthly fees associated with Amazon Prime memberships, as well as audiobook, digital video, e-book, digital music, and other non-AWS subscription services.

(5) Primarily includes sales of advertising services.

Amazon reported a 21% year-on-year increase in revenue to 63.4 billion US dollars in the second quarter, excluding the impact of currency movements. Sales in North America grew 20%, while international sales rose just 12%, impacted by currency movements. Amazon Web Services boosted revenues 37% to 8.4 billion dollars.

Revenues from subscription services, which includes Amazon Prime, rose 39% to 4.7 billion dollars. “Customers are responding to Prime’s move to one-day delivery — we’ve received a lot of positive feedback and seen accelerating sales growth,” said Jeff Bezos, Amazon founder and CEO. “Free one-day delivery is now available to Prime members on more than ten million items, and we’re just getting started. A big thank you to the team for continuing to make life easier for customers.”Source: Amazon statement

Alphabet Maintains Strong Growth

Alphabet reported a 22% year-on-year increase in revenues at constant currencies to 38.9 billion US dollars for the second quarter, driven by mobile search advertising, YouTube and cloud services. That increase is down slightly from the 23% rise achieved in the same quarter in 2018.

Capital spending in the second quarter was up 12% year-on-year to 6.1 billion dollars, while R&D spending rose 21% to 6.2 billion dollars. Source: Alphabet statement

Capital spending in the second quarter was up 12% year-on-year to 6.1 billion dollars, while R&D spending rose 21% to 6.2 billion dollars. Source: Alphabet statement

Thursday, July 25, 2019

Model 3 Motoring for Tesla

Tesla reported a 59% year-on-year increase in sales for the second quarter to 6.35 billion US dollars, as shipments of its Model 3 vehicle leapt 321%. "This is an important milestone as it represents rapid progress in managing global logistics and delivery operations at higher volumes," said Elon Musk, Tesla's CEO. "Local production and improved utilisation of existing factories is essential to be cost competitive in each region. We remain on track to launch local production of the Model 3 in China by the end of the year and Model Y in Fremont by fall of 2020. We are also accelerating our European Gigafactory efforts and are hoping to finalise a location choice in the coming quarters. We are working to increase our deliveries sequentially and annually, with some expected fluctuations from seasonality. This is consistent with our previous guidance of 360,000 to 400,000 vehicle deliveries this year." source: Tesla statement

AT&T's Entertainment Group Sheds Subs

AT&T's Entertainment Group reported revenues of 11.4 billion US dollars for the second quarter, down 1% year-on-year due to declines in TV subscribers and legacy services. Video revenues fell 1.7% to 8 billion dollars, as declines in premium TV subscribers were only partially offset by the growth of over-the-top revenues. However, IP broadband revenues climbed 6.5% to 2.1 billion dollars, as subscribers shifted to higher-speed services, including AT&T Fiber. Source: AT&T documents

Wednesday, July 24, 2019

Microsoft on Cloud Nine

"Our commercial cloud business is the largest in the world, surpassing 38 billion dollars in revenue for the year, with gross margin expanding to 63%," said Microsoft CEO Satya Nadella. "We are building Azure as the world’s computer, addressing customers’ real-world operational sovereignty and regulatory needs. We have 54 data center regions, more than any other cloud provider, and we were the first in the Middle East and in Africa." source: Microsoft statement

Tuesday, July 23, 2019

Ericsson Feels 5G Bounce

Ericsson reported a 7% year-on-year increase in sales on a like-for-like basis to 54.8 billion Swedish krona (5.8 billion US dollars) for the second quarter. It said the increase was driven by growth in its networks division in North America and North East Asia.

Börje Ekholm, CEO of Ericsson, said: "We see strong momentum in our 5G business with both new contracts and new commercial launches as well as live networks. To date, we have provided solutions for almost two-thirds of all commercially launched 5G networks....Initially, 5G will be a capacity enhancer in metropolitan areas. However, over time, new exciting innovations for 5G will come with IoT use cases, leveraging the speed, latency and security 5G can provide." Source: Ericsson statement

Thursday, May 16, 2019

Cisco Sees Strong Demand for Applications and Security

Cisco reported a 6% rise in revenues on a like-for-like basis to 13 billion US dollars for the quarter ending April 27, 2019. It said that product revenue was up 7% and service revenue up 3%, while revenue in the Americas was up 9%, EMEA up 5%, and APJC (Asia Pacific, Japan and China) was down 4%. source: Cisco statement

Tuesday, May 14, 2019

Competitive Headwinds Hit Vodafone

Vodafone reported a 0.6% year-on-year fall in organic service revenue (excluding handset financing and settlements in Germany) for the quarter ending March 31, as it struggled with "increased competition in Spain and Italy and headwinds in South Africa." Group revenues for the financial year ending March 31 were 43.7 billion euros.

Group CEO Nick Read said Vodafone intends "to build Europe’s largest 5G network, reaching over 50 cities by the end of [March 2020] following commercial launches during the summer. In addition to potential new revenue streams, 5G’s improved spectral and energy efficiency supports up to a 10x reduction in the cost per gigabyte, which will allow the group to limit future growth in network operating costs despite strong expected traffic growth."

Vodafone said it now has 37 million customers using its M-Pesa financial services suite, with over 10 billion euros of payments processed over the platform each month across seven African markets. In the year to March 31, M-Pesa grew revenues by 20.7% to 750 million euros, which represented 12% of the group's "emerging consumer" service revenues. "M-Pesa, our African payments platform, has moved beyond its origins as a money transfer service, and now provides enterprise payments, financial services and merchant payment services for mobile commerce," Nick Read noted. Source: Vodafone statement

Thursday, May 9, 2019

Deutsche Telekom Cranks up Capex

Deutsche Telekom reported a 3.5% rise in revenues on an organic basis to 19.5 billion euros for the first quarter of 2019. In the U.S., total revenue increased by 7% to 11.1 billion U.S. dollars, as T-Mobile USA continued to add new customers.

The group said that cash capex, excluding expenses for mobile spectrum, rose almost 20% to 3.7 billion euros. "This increase was attributable to the accelerated network build-out in the United States and further extensive investments to build out and modernise the network in Germany," it added.

DT said the number of customers in Germany with fiber-optic-based products increased by 688,000 in the quarter, reaching 12.9 million at the end of March, up 24% year-on-year. "Interest in these products rose tangibly with the launch of MagentaTV, the next development level in Deutsche Telekom’s IP TV offering," it added. DT said exclusive content helped it attract 66,000 new MagentaTV customers in the first quarter, taking the total number to 3.4 million, an increase of 7.1% compared with March 2018." source: Deutsche Telekom statement

The group said that cash capex, excluding expenses for mobile spectrum, rose almost 20% to 3.7 billion euros. "This increase was attributable to the accelerated network build-out in the United States and further extensive investments to build out and modernise the network in Germany," it added.

DT said the number of customers in Germany with fiber-optic-based products increased by 688,000 in the quarter, reaching 12.9 million at the end of March, up 24% year-on-year. "Interest in these products rose tangibly with the launch of MagentaTV, the next development level in Deutsche Telekom’s IP TV offering," it added. DT said exclusive content helped it attract 66,000 new MagentaTV customers in the first quarter, taking the total number to 3.4 million, an increase of 7.1% compared with March 2018." source: Deutsche Telekom statement

Wednesday, May 1, 2019

Competition Cramps Orange France

On a comparable basis, Orange reported a 0.1% fall in revenues to 10.2 billion euros for the first quarter. Although revenues rose 5% in the Middle East and Africa, the group was dragged down by a 1.8% fall in revenues in France, where it faced a "fierce promotional environment."

Fixed-mobile "convergence continues to be an engine for growth and loyalty for the group," noted Stéphane Richard, CEO of the Orange Group. "We are the European leader in this field with over 10 million customers, representing nearly 40% of our consumer revenues for the continent."

Orange Money revenues climbed 29% in the first quarter of 2019 with the active customer base growing 20% year-on-year to15.5 million. "This quarter marks a new milestone in our multi-services operator strategy," added Richard. "In addition to our initiatives in mobile financial services in Africa and Europe, we have launched two new offers in France that will capitalise on our presence in the home: “Home protection” is a remote monitoring service that is already off to a very encouraging start, and “Connected home” brings together our ambitions for IoT in the home." source: Orange statement

Fixed-mobile "convergence continues to be an engine for growth and loyalty for the group," noted Stéphane Richard, CEO of the Orange Group. "We are the European leader in this field with over 10 million customers, representing nearly 40% of our consumer revenues for the continent."

Orange Money revenues climbed 29% in the first quarter of 2019 with the active customer base growing 20% year-on-year to15.5 million. "This quarter marks a new milestone in our multi-services operator strategy," added Richard. "In addition to our initiatives in mobile financial services in Africa and Europe, we have launched two new offers in France that will capitalise on our presence in the home: “Home protection” is a remote monitoring service that is already off to a very encouraging start, and “Connected home” brings together our ambitions for IoT in the home." source: Orange statement

Apple Forecasts Flat Quarter Ahead

|

| Apple's revenues, year-on-year comparison |

Friday, April 26, 2019

Amazon Keeps Adding Billions In Revenues

Amazon said it expects its revenue to grow by between 15% and 20% year-on-year in the second quarter to between 59.5 billion and 63.5 billion dollars. This guidance anticipates an unfavourable impact of approximately 150 basis points from foreign exchange rates. For the first quarter of 2019, Amazon reported a 19% increase in sales on a like-for-like basis to 59.7 billion dollars. Sales in North America were up 17%, international sales up 19% and AWS was up 42%. source: Amazon statement

Wednesday, April 24, 2019

Huawei Reports Rapid Revenue Growth

Despite a barrage of negative publicity, Huawei reported a 39% year-on-year increase in revenue for the first quarter of 2019 to 179.7 billion Chinese yuan (28.8 billion US dollars). Huawei said it had signed 40 commercial 5G contracts with operators by the end of March 2019, and had shipped more than 70,000 5G base stations, adding 2019 will see "large-scale deployment of 5G around the world".

Huawei also said it shipped 59 million smartphones in the first quarter. Moreover, it claimed to have launched the world's first 5G-enabled Wi-Fi 6 access point, and to have shipped more Wi-Fi 6 products than any other company worldwide. source: Huawei statement

Huawei also said it shipped 59 million smartphones in the first quarter. Moreover, it claimed to have launched the world's first 5G-enabled Wi-Fi 6 access point, and to have shipped more Wi-Fi 6 products than any other company worldwide. source: Huawei statement

North America Boosts Ericsson

Ericsson reported a 7% organic year-on-year increase in sales for the first quarter of 2019 to 48.9 billion Swedish Krona (4.7 billion euros). The rise was fuelled by strong demand in North America for both 4G and 5G equipment, as well as 5G sales in South Korea. Ericsson says it expects sales in North America to remain strong and large 5G deployments in parts of Asia to commence at the end of 2019. Source: Ericsson presentation

Thursday, April 18, 2019

Uber Touts Massive Market Opportunity

Uber claims its total addressable market (TAM) in personal mobility is worth 5.7 trillion US dollars per annum. That represents 11.9 trillion miles of travel per year by the inhabitants of 175 countries, Uber reported in its IPO prospectus, explaining: "We include all passenger vehicle miles and all public transportation miles in all countries globally in our TAM, including those we have yet to enter, except for the 20 countries that we address through our ownership positions in our minority-owned affiliates ...We estimate that these 20 countries represent an additional estimated market opportunity of approximately 0.5 trillion dollars."

In 2018, Uber spent 457 million dollars on R&D in autonomous vehicles and other new technologies, such as flying cars. "We expect to increase our investments in these new initiatives in the near term," Uber added. "We also expect to spend substantial amounts to purchase additional dockless e-bikes and e-scooters, which are susceptible to theft and destruction, as we seek to build our network and increase our scale, and to expand these products to additional markets."

Uber says its Advanced Technologies Group, which has more than 1,000 employees working in Pittsburgh, San Francisco, and Toronto, has built over 250 self-driving vehicles, collected data from millions of autonomous vehicle testing miles, and completed tens of thousands of passenger trips. "We believe that there will be a long period of hybrid autonomy, in which autonomous vehicles will be deployed gradually against specific use cases while drivers continue to serve most consumer demand," Uber said. "As we solve specific autonomous use cases, we will deploy autonomous vehicles against them. Such situations may include trips along a standard, well-mapped route in a predictable environment in good weather. In other situations, such as those that involve substantial traffic, complex routes, or unusual weather conditions, we will continue to rely on drivers....Deciding which trip receives a vehicle driven by a driver and which receives an autonomous vehicle, and deploying both in real time while maintaining liquidity in all situations, is a dynamic that we believe is imperative for the success of an autonomous vehicle future. " source: Uber IPO prospectus

In 2018, Uber spent 457 million dollars on R&D in autonomous vehicles and other new technologies, such as flying cars. "We expect to increase our investments in these new initiatives in the near term," Uber added. "We also expect to spend substantial amounts to purchase additional dockless e-bikes and e-scooters, which are susceptible to theft and destruction, as we seek to build our network and increase our scale, and to expand these products to additional markets."

Uber says its Advanced Technologies Group, which has more than 1,000 employees working in Pittsburgh, San Francisco, and Toronto, has built over 250 self-driving vehicles, collected data from millions of autonomous vehicle testing miles, and completed tens of thousands of passenger trips. "We believe that there will be a long period of hybrid autonomy, in which autonomous vehicles will be deployed gradually against specific use cases while drivers continue to serve most consumer demand," Uber said. "As we solve specific autonomous use cases, we will deploy autonomous vehicles against them. Such situations may include trips along a standard, well-mapped route in a predictable environment in good weather. In other situations, such as those that involve substantial traffic, complex routes, or unusual weather conditions, we will continue to rely on drivers....Deciding which trip receives a vehicle driven by a driver and which receives an autonomous vehicle, and deploying both in real time while maintaining liquidity in all situations, is a dynamic that we believe is imperative for the success of an autonomous vehicle future. " source: Uber IPO prospectus

Friday, March 29, 2019

U.S. Telcos Struggle to Cover Cost of Capital

The big four telcos in the U.S. are not exactly raking it in. Between 2010 and 2018, AT&T, Verizon, T-Mobile USA and Sprint achieved an average aggregate return-on-capital employed (ROCE) of just 7%. The NYU Stern School of Business has estimated that the average cost of capital for the U.S. telecoms service sector is 6.9%. In 2018, aggregate ROCE was also 7%.

In other words, the industry is barely covering its cost of capital. Within that overall picture, some telcos are performing better than others. Verizon has been the best long-term performer on this measure, making an average ROCE of 10% across the nine years. T-Mobile USA has made an extraordinary recovery in the past six years, lifting ROCE to almost 10% in 2017 and 2018 from a low of -20% in 2012. But the company’s average annual ROCE for the decade is just 1%, underlining why it is pursuing the merger with Sprint. Sprint is the weakest of the four, earning almost no return on the capital it has employed across the decade.

AT&T’s average ROCE in the 2010-2018 period is just 7%. The telco’s performance on this metric has been dragged down in recent years by a massive leap in the capital it has employed following the acquisitions of DirecTV and Time Warner.

The chart above is one of many in a high-level guide to the financial state of the U.S.’s top telcos. This new report enables long-term investors and policymakers to easily track the progress of the big four telcos - AT&T, Verizon, T-Mobile USA and Sprint - over the past nine years on a range of financial metrics.

The iPad edition is available here and the Kindle edition here.

The chart above is one of many in a high-level guide to the financial state of the U.S.’s top telcos. This new report enables long-term investors and policymakers to easily track the progress of the big four telcos - AT&T, Verizon, T-Mobile USA and Sprint - over the past nine years on a range of financial metrics.

The iPad edition is available here and the Kindle edition here.

Tuesday, March 26, 2019

The Cash Chasm in U.S. Telecoms

Although T-Mobile USA has made the U.S. telecoms market more competitive in recent years, it remains a fraction of the size of the big two: AT&T and Verizon. As the above graphic shows, in this decade, T-Mobile USA has generated less than 15% of the cash thrown off by AT&T, while Sprint’s operations have produced less than 12%.

In 2018, AT&T generated approximately $45 billion from its operations, bringing the total for the decade up to $334 billion. By contrast, T-Mobile USA is now generating about $8 billion a year from its operations, up from just $4 billion in the middle of the decade.

Those stats help explain why T-Mobile USA and Sprint are so keen to merge, ahead of the rollout of 5G. Individually, they are not generating anywhere near enough cash to invest in the next generation infrastructure required to challenge the market leaders.

The chart above is one of many in a high-level guide to the financial state of the U.S.’s top telcos. This new report enables long-term investors and policymakers to easily track the progress of the big four telcos - AT&T, Verizon, T-Mobile USA and Sprint - over the past nine years on a range of financial metrics.

The iPad edition is available here and the Kindle edition here.

Note, the above figures are based on the accounting methodology used by these telcos for most of the decade, but include estimates for 2018, when the industry switched to a new accounting standard.

Friday, March 22, 2019

Online Payments and Advertising Drive Tencent Forward

Tencent reported a 32% increase in revenues to 313 billion yuan for 2018 (45.6 billion US dollars). However, in the fourth quarter revenue growth slowed to 28%.

Revenues from its VAS business (online gaming and social networks) increased by 9% in the fourth quarter of 2018, as online games revenues were flat at 24.2 billion yuan. However, social networks revenues grew by 25% to 19.5 billion yuan, lifted by growth in revenues from digital content services, such as live broadcast services and video streaming subscriptions. Tencent said its total digital content subscriptions exceeded 100 million at the end of 2018, up 50% year-on-year.

Revenues from the online advertising business increased by 38% to 17 billion yuan for the fourth quarter. That rise was driven by a 44% rise in "social and others advertising" revenues to 11.8 billion yuan, thanks to Weixin Moments, Mini Programs and QQ KanDian. Tencent increased its advertising inventory by adding a second ad unit in Weixin Moments, and started to insert ad units into Mini Programs, which run within the WeChat/Weixin messaging service. The Mini Programs now cover more than 200 service sectors. Media advertising revenues grew by 26% to 5.2 billion yuan, fuelled by contributions from Tencent Video and Tencent News.

Revenues from other businesses, such as digital payments, cloud services and TV production, increased by 72% to 24.2 billion yuan for the fourth quarter. Tencent reported that its payment platforms supported more than one billion transactions a day in 2018, driven by rapid growth in commercial payments, which accounted for more than half the transactions. Source: Tencent statement

Large Scale IoT Lifts China Mobile

China Mobile reported a 1.8% rise in revenues for 2018 to 737 billion Chinese yuan (110 billion US dollars) on a like-for-like basis. Service revenue rose 3.7% on a like-for-like basis, and 0.4% on a reported basis. Intriguingly, China Mobile even reported a rise in SMS/MMS revenue (see chart above).

IoT revenue climbed 40% to 7.53 billion yuan (1.12 billion dollars), as China Mobile said it is now serving 551 million "smart IoT" connections up from from 229 million at the end of 2017. That suggests an average annual revenue per IoT connection of about 3 dollars. China Mobile is aiming to add a further 300 million net IoT connections in 2019, as it seeks to become the first operator serving two billion connections in total. However, it is planning another cut in capex in 2019 (see chart below). Source: China Mobile presentation

IoT revenue climbed 40% to 7.53 billion yuan (1.12 billion dollars), as China Mobile said it is now serving 551 million "smart IoT" connections up from from 229 million at the end of 2017. That suggests an average annual revenue per IoT connection of about 3 dollars. China Mobile is aiming to add a further 300 million net IoT connections in 2019, as it seeks to become the first operator serving two billion connections in total. However, it is planning another cut in capex in 2019 (see chart below). Source: China Mobile presentation

Thursday, March 21, 2019

How Cash-strapped are Europe's Top Telcos?

Cash flow will play a big part in determining how fast Europe's debt-laden telcos roll out 5G. The chart above aggregates the net cash flow generated by the operations of Deutsche Telekom, Vodafone, Telefónica, Orange and Telecom Italia, and their capital spending, over the course of this decade. Despite an upswing in recent years, it shows how their operations are still not generating as much cash as they were in 2010. The chart also flags how the big five telcos' capex has slid downwards since 2015.

Worryingly, the upward trend in cash flow came to an abrupt halt in 2018 as competition and economic uncertainty kept a lid on pricing power. Only Deutsche Telekom, boosted by revenue growth in the U.S. and cost cutting, generated significantly more net cash from its operating activities in 2017 and 2018 than in previous years. Since 2010, the Bonn-based group has seen cash generation rise by 22%.

At the other end of the spectrum, Orange has seen a 24% decline in the cash generated by its operations since 2010. The Paris-based telco has had to cut prices in response to aggressive tactics by new entrants in its home market. In 2018, this metric declined again as Orange made large payments to French employees impacted by restructuring, but the group has forecast growth in operating cash flow for 2019.

Pringle Media has just published a report tracking and comparing the key financial metrics of these five major telcos over the past nine years.

Thursday, March 7, 2019

MTN Delivers Double Digit Growth

MTN reported a 10.2% increase in revenue for 2018 at constant exchange rates to 134 billion South African rand (9.3 billion US dollars). In Nigeria, service revenue leapt 17%, fuelled by strong demand for both voice and data services.

Group revenues from digital services, such as music, fell 33% to 3.9 billion rand "as a result of the ongoing value-added-services optimisation", while fintech revenues climbed 47% to 7.8 billion rand. Group capex fell to 19.3% of revenues, from 24% in 2017, as MTN benefitted from the deployment of low frequency spectrum offering broad coverage. MTN expects service revenues, including those from digital services, to grow at double digit rates in the medium-term. Source: MTN statements

Friday, February 22, 2019

Telefónica Claims Remarkable Operating Momentum

Telefónica reported a 3% year-on-year growth in revenues on an organic basis for the fourth quarter of 2018 to 12.9 billion euros. The Madrid-based group forecast that revenues will grow about 2% on an organic basis in 2019 (compared with 2.4% in 2018).

José María Álvarez-Pallete, CEO, said: " In 2018, we regained customer relevance, resulting in the best-ever figure of customer satisfaction. We continued increasing the weight of high-growing revenues (broadband connectivity and services beyond connectivity) and investing in state-of-the-art technology networks. ...This performance, together with the remarkable operating momentum in the initial months of 2019, allow us to announce with confidence our 2019 targets of continue growing in revenues and OIBDA, as we keep the capex/sales ratio stable.”

Telefónica said digital services generated 6.79 billion euros in revenue in 2018 (up 24% year-on-year). Within that, video revenues totalled 2.88 billion euros (up 0.5%), while cloud generated 627 million euros (24.2%), IoT 376 million euros (31%) and security 433 million euros (41.7%). The group's "Contents" revenue was up 86% to 1.83 billion euros, reflecting rising demand for its over-the-top (OTT) content propositions. Source: Telefónica statement

José María Álvarez-Pallete, CEO, said: " In 2018, we regained customer relevance, resulting in the best-ever figure of customer satisfaction. We continued increasing the weight of high-growing revenues (broadband connectivity and services beyond connectivity) and investing in state-of-the-art technology networks. ...This performance, together with the remarkable operating momentum in the initial months of 2019, allow us to announce with confidence our 2019 targets of continue growing in revenues and OIBDA, as we keep the capex/sales ratio stable.”

Telefónica said digital services generated 6.79 billion euros in revenue in 2018 (up 24% year-on-year). Within that, video revenues totalled 2.88 billion euros (up 0.5%), while cloud generated 627 million euros (24.2%), IoT 376 million euros (31%) and security 433 million euros (41.7%). The group's "Contents" revenue was up 86% to 1.83 billion euros, reflecting rising demand for its over-the-top (OTT) content propositions. Source: Telefónica statement

Thursday, February 21, 2019

Deutsche Telekom Predicts Slight Growth in 2019

Deutsche Telekom reported a 3.1% year-on-year rise in revenues on an organic basis to 75.7 billion euros for 2018. It expects a "slight increase" in group revenues in 2019, followed by an "increase" in 2020. Once again, T-Mobile US is the primary growth engine. In 2018, T-Mobile US saw its revenues grow 6.8% to 43.1 billion U.S. dollars. source: Deutsche Telekom statement

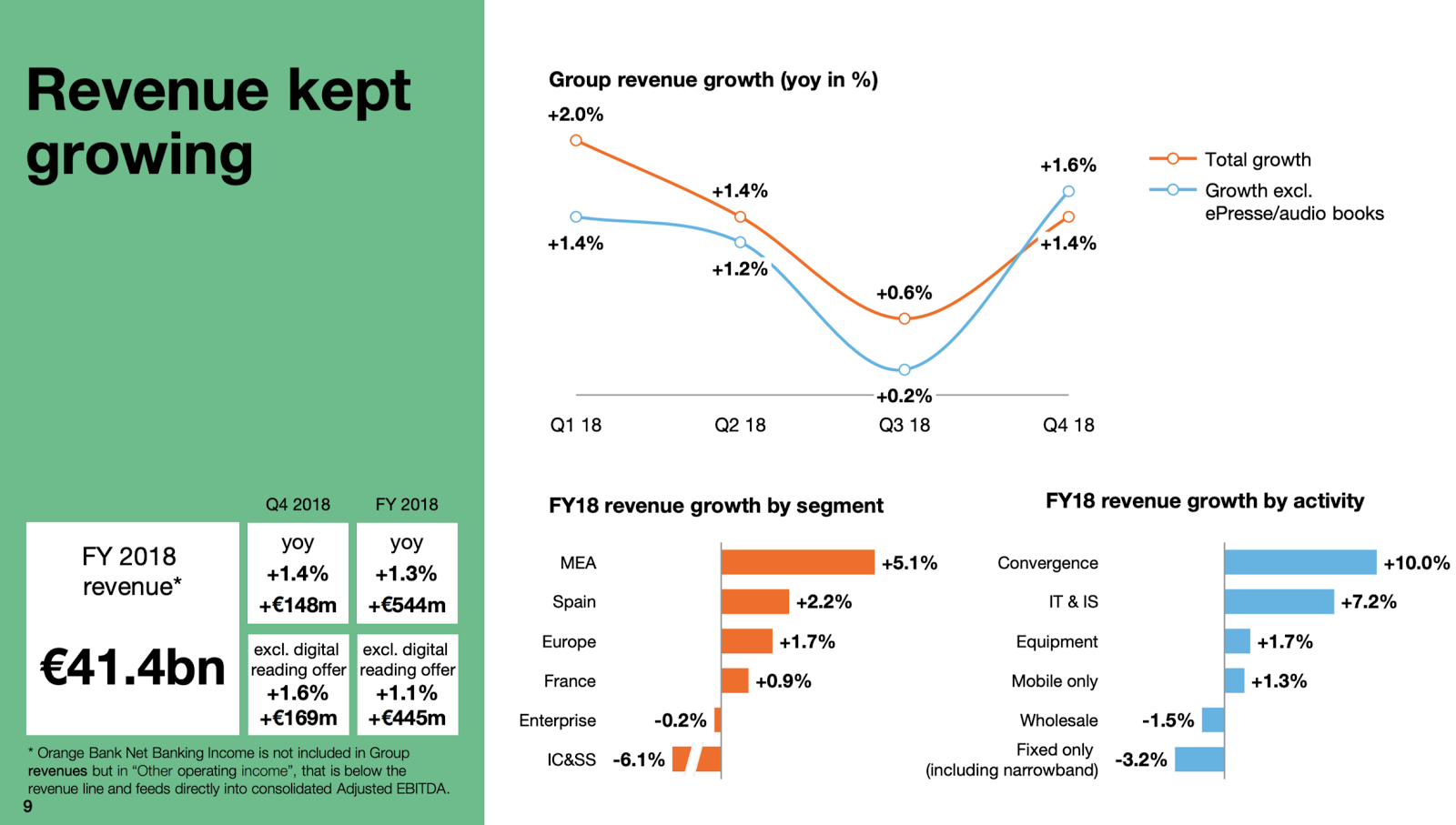

Africa and Middle East Bolster Orange

Orange reported a 1.4% year-on-year increase in revenues on a comparable basis for the fourth quarter of 2018 to 10.81 billion euros, up from 0.6% in the third quarter.

For the whole of 2018, revenues rose 1.3% to 41.38 billion euros. Orange said a 5.1% increase in revenues in Africa & Middle East accounted for almost half of the group's growth in 2018, driven by data and mobile financial services. Revenue growth in Spain (up 2.2%), Europe (up 1.7%) and France (up 0.9%) was driven by convergence (a combined mobile and fixed offering).

Orange CEO, Stéphane Richard, said: "Our leadership in terms of connectivity is the foundation of our well-established multi-service strategy. In terms of content, we celebrated 10 years of OCS (Orange Cinéma Séries) which now has nearly 3 million clients. In financial services, Orange Bank has attracted nearly 250,000 clients in France and Orange Money continued its strong growth to reach 14 million active clients." source: Orange statement

Wednesday, February 13, 2019

América Móvil Sees Steady Growth

América Móvil reported a 3% year-on-year increase in service revenues for the fourth quarter of 2016, at constant exchange rates. That was approximately the same rate of growth as in the prior quarter, as the acceleration of service-revenue growth in Colombia, the U.S. and Argentina was offset by a slight deceleration in Brazil and Mexico "stemming from aggressive holiday promotions that included large allotments of data and airtime." Total revenues for the quarter were 262 billion Mexican pesos (13.52 billion US dollars).

América Móvil said its fixed-broadband business in Brazil posted 15.3% revenue growth. claiming that it captured almost 62% of new connections in the "ultra-broadband market." Source: América Móvil statement.

América Móvil said its fixed-broadband business in Brazil posted 15.3% revenue growth. claiming that it captured almost 62% of new connections in the "ultra-broadband market." Source: América Móvil statement.

Tuesday, February 5, 2019

New YouTube Products Propel Alphabet

Alphabet reported 23% year-on-year growth in revenues at constant currency to 39.3 billion US dollars for the fourth quarter of 2018, boosted by "ongoing strength in mobile search with important contributions from YouTube, cloud and desktop search."

"YouTube Music and YouTube Premium are now available in nearly 30 countries up from five countries at the start of 2018," said Sundar Pichai, Alphabet CEO. "Last month, YouTube TV announced that it has expanded nationwide to cover 98% of U.S households with the rest to follow shortly. YouTube continues to invest in its thriving community of creators and build great features for its nearly 2 billion monthly log in users....The number of YouTube channels with more than 1 million subscribers nearly doubled in the last year, and the number of creators earning five or six figures grew by more than 40% year-over-year." Source: Alphabet statements

"YouTube Music and YouTube Premium are now available in nearly 30 countries up from five countries at the start of 2018," said Sundar Pichai, Alphabet CEO. "Last month, YouTube TV announced that it has expanded nationwide to cover 98% of U.S households with the rest to follow shortly. YouTube continues to invest in its thriving community of creators and build great features for its nearly 2 billion monthly log in users....The number of YouTube channels with more than 1 million subscribers nearly doubled in the last year, and the number of creators earning five or six figures grew by more than 40% year-over-year." Source: Alphabet statements

Friday, February 1, 2019

Time Warner Boosts AT&T

Excluding the impact of an accounting change, AT&T said revenues rose 17.2% year-on-year to 48.9 billion US dollars in the fourth quarter, primarily due to the Time Warner acquisition. Declines in legacy wireline services, wireless equipment, domestic video and Vrio were more than offset by WarnerMedia and growth in domestic wireless services and Xandr, AT&T said. Xandr, the advertising business, reported a 49% increase in revenues (26% excluding the AppNexus acquisition).

In 2018, capital expenditures totalled 21.3 billion dollars, down from 21.6 billion dollars in 2017. In 2019, AT&T plans to increase capex to 23 billion dollars (including one billion dollars it expects to be reimbursed), as it rolls out 5G.

On a conference call with analysts, Randall Stephenson, CEO of AT&T, said: "Over a three-to-five year time horizon, unequivocally 5G will serve as a broadband, a fixed broadband replacement product... as we look at 5G, will you have enough capacity to have a good broadband product that serves as a streaming service for all of your DIRECTV NOW, your Netflix, etc.? I absolutely am convinced that we will have that capacity, particularly as we turn up millimetre wave spectrum. That's where the capacity and the performance comes from and that's where you'll begin to see a broad - a true replacement opportunity for fixed line broadband." Source: AT&T statement

Sales Growth Set to Slow for Amazon

Amazon said it expects net sales to be between 56 billion and 60 billion US dollars in the current quarter, which would represent year-on-year growth of between 10% and 18%. This guidance anticipates an unfavourable impact of approximately 210 basis points from foreign exchange rates.

In the fourth quarter of 2018, Amazon increased sales by 20% to 72.4 billion dollars. Excluding the impact of currency movements, sales would have risen 21%. Amazon said tens of millions of customers worldwide started Prime free trials or began paid memberships during the holiday season.

“The number of research scientists working on Alexa has more than doubled in the past year, and the results of the team’s hard work are clear," added Jeff Bezos, Amazon CEO. "In 2018, we improved Alexa’s ability to understand requests and answer questions by more than 20% through advances in machine learning, we added billions of facts making Alexa more knowledgeable than ever, developers doubled the number of Alexa skills to over 80,000, and customers spoke to Alexa tens of billions more times in 2018 compared to 2017.” Source: Amazon statement

In the fourth quarter of 2018, Amazon increased sales by 20% to 72.4 billion dollars. Excluding the impact of currency movements, sales would have risen 21%. Amazon said tens of millions of customers worldwide started Prime free trials or began paid memberships during the holiday season.

“The number of research scientists working on Alexa has more than doubled in the past year, and the results of the team’s hard work are clear," added Jeff Bezos, Amazon CEO. "In 2018, we improved Alexa’s ability to understand requests and answer questions by more than 20% through advances in machine learning, we added billions of facts making Alexa more knowledgeable than ever, developers doubled the number of Alexa skills to over 80,000, and customers spoke to Alexa tens of billions more times in 2018 compared to 2017.” Source: Amazon statement

Thursday, January 31, 2019

Sales Falls For Samsung Electronics

Samsung Electronics reported a 10% year-on-year fall in revenues for the fourth quarter of 2018 to 59.27 trillion Korean won (53 billion US dollars), driven by declines in its semiconductor and mobile divisions. It blamed the dip in sales in its mobile division on weak smartphone shipments, amid a stagnant market. Source: Samsung statements

Facebook Expects Further Deceleration

Facebook reported a 33% year-on-year increase in revenues on a constant currency basis for the fourth quarter to 16.9 billion US dollars, down from 34% in the third quarter.

For the current quarter, Facebook expects its total revenue growth rate to decelerate by a mid-single digit percentage on a constant currency basis compared to the fourth quarter rate. "We also expect that our revenue growth rates will continue to decelerate sequentially throughout 2019 on a constant currency basis," the company said.

It plans to invest between 18 billion and 20 billion dollars in capital expenditures in 2019, driven primarily by the building of data centres. For 2018, capital expenditure was 13.9 billion dollars.

Separately, Facebook shut down a mobile app that paid users 20 dollars a month for allowing it to collect data on their iPhones, after Apple said the app breached its policies. The app monitored the user's web and phone activity, including how they use other apps, according to a TechCrunch report. Source: Facebook statement

For the current quarter, Facebook expects its total revenue growth rate to decelerate by a mid-single digit percentage on a constant currency basis compared to the fourth quarter rate. "We also expect that our revenue growth rates will continue to decelerate sequentially throughout 2019 on a constant currency basis," the company said.

It plans to invest between 18 billion and 20 billion dollars in capital expenditures in 2019, driven primarily by the building of data centres. For 2018, capital expenditure was 13.9 billion dollars.

Separately, Facebook shut down a mobile app that paid users 20 dollars a month for allowing it to collect data on their iPhones, after Apple said the app breached its policies. The app monitored the user's web and phone activity, including how they use other apps, according to a TechCrunch report. Source: Facebook statement

Model 3 Drives Tesla to New Heights

Tesla reported a 134% year-on-year increase in automotive revenue for the fourth quarter of 2018 to 6.32 billion US dollars. The company claimed its Model 3 was the best-selling passenger car in the US in terms

of revenue in both the third and fourth quarter. "With nearly 140,000 units sold, Model 3

was also the best-selling premium vehicle (including SUVs) in the US for

2018 – the first time in decades an American carmaker has been able to

secure the top spot," Tesla said.

Tesla is expecting to deliver a total of 360,000 to 400,000 vehicles in 2019, representing year-on-year growth of approximately 45% to 65%. By the end of 2019, Tesla is planning to start producing Model 3 vehicles at its Gigafactory Shanghai where it hopes the capital spend per unit of capacity will be less than half of that of the existing Model 3 line in Fremont. The company said it is aiming for annualised Model 3 output in excess of 500,000 units sometime between the fourth quarter of 2019 and the second quarter of 2020.

Tesla recently launched “Navigate on Autopilot”, a feature that "allows, on most controlled-access roads such as highways, any Tesla vehicle with Enhanced Autopilot to change lanes, transition from one highway to another, and ultimately exit the highway when approaching the final destination."

Tesla also reported that energy generation and storage revenue in the fourth quarter increased by 25% year-on-year to 371 million dollars, mainly driven by a substantial growth in energy storage deployments. "Energy generation and storage revenue should increase significantly in 2019, mainly due to the storage business," Tesla said. Source: Tesla statement

Tesla is expecting to deliver a total of 360,000 to 400,000 vehicles in 2019, representing year-on-year growth of approximately 45% to 65%. By the end of 2019, Tesla is planning to start producing Model 3 vehicles at its Gigafactory Shanghai where it hopes the capital spend per unit of capacity will be less than half of that of the existing Model 3 line in Fremont. The company said it is aiming for annualised Model 3 output in excess of 500,000 units sometime between the fourth quarter of 2019 and the second quarter of 2020.

Tesla recently launched “Navigate on Autopilot”, a feature that "allows, on most controlled-access roads such as highways, any Tesla vehicle with Enhanced Autopilot to change lanes, transition from one highway to another, and ultimately exit the highway when approaching the final destination."

Tesla also reported that energy generation and storage revenue in the fourth quarter increased by 25% year-on-year to 371 million dollars, mainly driven by a substantial growth in energy storage deployments. "Energy generation and storage revenue should increase significantly in 2019, mainly due to the storage business," Tesla said. Source: Tesla statement

Wednesday, January 30, 2019

Apple Sees Sales Slide Continuing

Source: Statista

Source: StatistaApple forecast revenue for the quarter ending March 31st will fall to between 55 billion and 59 billion dollars from 61.6 billion in the same quarter of 2018. That would represent a year-on-year decline of between 4% and 11% For the quarter ending December 29, it reported a 5% fall in revenues fo 84.3 billion dollars. Revenue from iPhones declined 15% from the prior year, while total revenue from all other products and services grew 19%.

Apple also said that more than half of the 1.8 billion iPhones it has ever sold are still in use, accounting for the bulk of the total 1.4 billion Apple devices in active use, which also include Macs, iPads and Apple Watches. source: Apple statement

Tuesday, January 29, 2019

Verizon Reports Modest Growth

Verizon reported a 0.5% increase in total operating revenue to 34.3 billion US dollars for the fourth quarter of 2018, excluding the impact of the new revenue recognition standard. For the whole of 2018, on a comparable basis, operating revenues grew approximately 2.2% to 130.9 billion dollars. Verizon said the "primary driver of the increase was continued wireless service revenue growth driven by step ups in access and net account growth."

Verizon also said IoT (Internet of Things) fourth-quarter revenues, including its Verizon Connect telematics business, increased approximately 9.5% year over year, excluding the impact of the revenue recognition standard. source: Verizon statement

Verizon also said IoT (Internet of Things) fourth-quarter revenues, including its Verizon Connect telematics business, increased approximately 9.5% year over year, excluding the impact of the revenue recognition standard. source: Verizon statement

Friday, January 25, 2019

Stagnant Vodafone Sees Reasons for Optimism

Vodafone reported a decline of 0.8% in group service revenue on an organic basis for the quarter ending December 31st. However, it said, excluding the impact of UK handset financing, organic service revenue would have risen slightly. "Growth in the majority of markets was offset by declines in Italy and in Spain, which were impacted by increased competition," Vodafone said.

Vodafone Business service revenues declined by 0.5% in the quarter, despite a 3.5% growth in fixed-line revenues "due to ongoing market share gains and strong growth in cloud services." But the mobile revenues in the business division were hit by a weaker performance at Vodacom and increased pricing pressure in Europe, particularly in the SoHo segment, as well as a slowdown in the automotive part of its IoT business. However, Vodafone said IoT connectivity revenues continued to grow strongly, with 27% growth in SIM connections to 80.9 million.

Vodafone also reported that its African payments platform M-Pesa (including Safaricom) maintained good momentum, with active customers growing 14% to 37 million, and transaction volumes up 27% in the quarter. Source: Vodafone statement

Thursday, January 3, 2019

Weakness in China and Sluggish iPhone Sales Hit Apple

Apple revised its guidance for the quarter that ended on December 29. It now expects to report revenues of approximately 84 billion US dollars, having projected sales of between 89 billion and 93 billion dollars. Apple posted revenue of 88.3 billion dollars in the equivalent quarter in 2017.

In a letter to investors, CEO Tim Cook said the economic weakness in some emerging markets "turned out to have a significantly greater impact than we had projected," resulting in fewer iPhone upgrades than Apple had anticipated.

"Most of our revenue shortfall to our guidance, and over 100% of our year-over-year worldwide revenue decline, occurred in Greater China across iPhone, Mac and iPad," Cook wrote. "China’s economy began to slow in the second half of 2018."

However, Cook also admitted that, in some developed markets, "iPhone upgrades also were not as strong as we thought they would be. While macroeconomic challenges in some markets were a key contributor to this trend, we believe there are other factors broadly impacting our iPhone performance, including consumers adapting to a world with fewer carrier subsidies, US dollar strength-related price increases, and some customers taking advantage of significantly reduced pricing for iPhone battery replacements."

On a brighter note, Apple said that services generated over 10.8 billion dollars in revenue during the quarter, while sales of wearables grew by almost 50% year-over-year. Source: Apple statement

In a letter to investors, CEO Tim Cook said the economic weakness in some emerging markets "turned out to have a significantly greater impact than we had projected," resulting in fewer iPhone upgrades than Apple had anticipated.

"Most of our revenue shortfall to our guidance, and over 100% of our year-over-year worldwide revenue decline, occurred in Greater China across iPhone, Mac and iPad," Cook wrote. "China’s economy began to slow in the second half of 2018."

However, Cook also admitted that, in some developed markets, "iPhone upgrades also were not as strong as we thought they would be. While macroeconomic challenges in some markets were a key contributor to this trend, we believe there are other factors broadly impacting our iPhone performance, including consumers adapting to a world with fewer carrier subsidies, US dollar strength-related price increases, and some customers taking advantage of significantly reduced pricing for iPhone battery replacements."

On a brighter note, Apple said that services generated over 10.8 billion dollars in revenue during the quarter, while sales of wearables grew by almost 50% year-over-year. Source: Apple statement

Subscribe to:

Posts (Atom)