Alphabet, the owner of Google, reported a 15% year-on-year increase in first quarter revenues at constant currency to 41.2 billion US dollars. The rise was driven by search-related advertising, YouTube and cloud services, but demand began to fall away towards the end of the quarter as the impact of COVID-19 became apparent.

Google Search and other advertising revenues amounted to 24.5 billion dollars, up 9% year-over-year, for the quarter. "This reflects strong year-on-year growth for the first two months of the quarter," Alphabet said. "In March, revenues began to decline and ended the month at a mid-teens percentage decline in year-on-year revenues."

YouTube advertising revenues were up 33% to 4 billion dollars, while Google Cloud, including GCP and G Suite, reported a 52% rise in revenues to 2.8 billion dollars. "Other Revenues" were 4.4 billion dollars, up 23% year-over-year, primarily driven by growth in YouTube subscriptions and sales through the Google Play app store. Alphabet said there are now more than 2.5 billion monthly active Play devices worldwide.

Alphabet also said its video conferencing platform Meet is now adding roughly 3 million new users each day, and has seen a thirty fold increase in usage since January. There are now over 100 million daily Meet meeting participants, it added. Source: Alphabet statements

About this weblog

What you need to know: This weblog captures key data points about the global telecoms industry. I use it as an electronic notebook to support my work for Pringle Media.

Thursday, April 30, 2020

Monday, April 27, 2020

Europe's Telcos Grapple with Capex Conundrum

Over the past decade, Deutsche Telekom has been the biggest spender, investing over 100 billion euros in plant, property and equipment. However, Telecom Italia leads in terms of capital intensity: It spent an extraordinary one quarter of its revenues on capex in 2015, 2016 and 2017, before scaling back to 22% in 2018 and 21% in 2019.

Pringle Media has just published a 60 page report tracking and comparing the key financial metrics of these five major telcos over the past decade: Screen shots of eight sample pages below.

Note, some of the Vodafone figures for the fourth quarter of 2019 are estimates, as the company hasn't reported for that period yet.

If you would like to purchase a PDF copy of the report, priced at 100 euros for a company-wide license, please email: pringled@btinternet.com.

Saturday, April 25, 2020

Verizon Reports Lockdown Traffic Surge

Verizon reported a 1.6% year-on-year decline in revenue for the first quarter to 31.6 billion US dollars, as wireless equipment revenue fell almost 19% amid the Covid-19 lockdown.

The US telco reported capital expenditures for the quarter of 5.3 billion dollars "to support the capacity for unprecedented traffic growth across Verizon's networks and the deployment of fiber and additional cell sites to support the company's 5G Ultra Wideband rollout." source: Verizon statement

Thursday, April 23, 2020

AT&T Takes Big Entertainment Hit

AT&T reported a 4.5% year-on-year fall in revenues to 42.8 billion US dollars for the first quarter of 2020. It said that 600 million of the 2 billion dollars shortfall was due to COVID-19, as sports advertising and wireless equipment sales suffered.

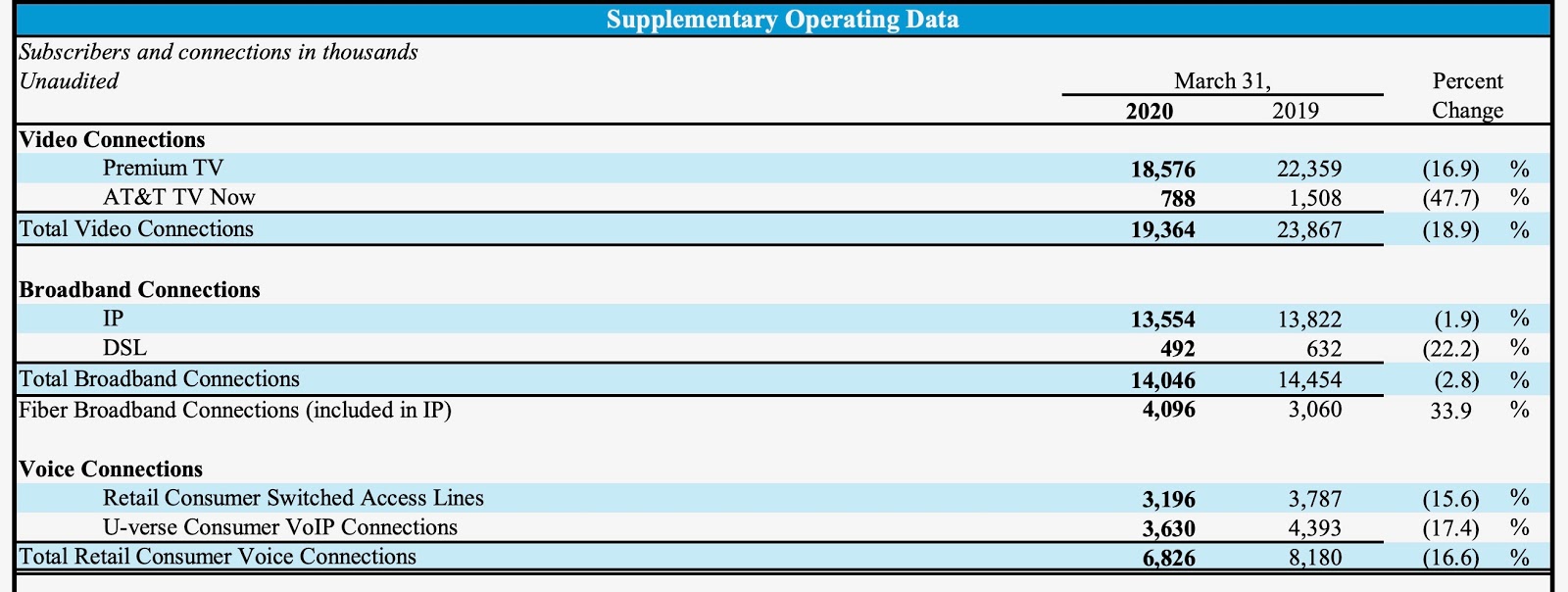

In the telco's communications division, revenues fell 2.6% to 34.2 billion dollars due to declines in the entertainment group, wireless equipment and business wireline that were partially offset by gains in wireless service revenues. In the first quarter, premium TV subscribers (which includes DirecTV, U-verse and AT&T TV subscribers) fell by 897,000 "due to competition and customers rolling off promotional discounts as well as lower gross adds from the continued focus on adding higher-value customers." The video-on-demand service AT&T TV NOW saw a net loss of 138,000 subscribers due to higher prices and less promotional activity. AT&T is planning to launch HBO Max at the end of May.

In the Warner Media division, revenue was down 12.2% to 7.4 billion dollars, while revenues from Latin America fell 7.5% to 1.6 billion dollars as foreign exchange pressures more than offset growth in Mexico. Source: AT&T statement

In the telco's communications division, revenues fell 2.6% to 34.2 billion dollars due to declines in the entertainment group, wireless equipment and business wireline that were partially offset by gains in wireless service revenues. In the first quarter, premium TV subscribers (which includes DirecTV, U-verse and AT&T TV subscribers) fell by 897,000 "due to competition and customers rolling off promotional discounts as well as lower gross adds from the continued focus on adding higher-value customers." The video-on-demand service AT&T TV NOW saw a net loss of 138,000 subscribers due to higher prices and less promotional activity. AT&T is planning to launch HBO Max at the end of May.

In the Warner Media division, revenue was down 12.2% to 7.4 billion dollars, while revenues from Latin America fell 7.5% to 1.6 billion dollars as foreign exchange pressures more than offset growth in Mexico. Source: AT&T statement

Wednesday, April 22, 2020

Netflix Pauses Most of its Productions

Netflix reported a 28% year-on-year rise in revenues for the first quarter to 5.77 billion U.S. dollars, as the number of paying subscribers rose 23% to almost 183 million. It forecast that revenue will grow 23% in the current quarter.

"Like other home entertainment services, we’re seeing temporarily higher viewing and increased membership growth," Netflix said. "In our case, this is offset by a sharply stronger US dollar, depressing our international revenue, resulting in revenue-as-forecast. We expect viewing to decline and membership growth to decelerate as home confinement ends, which we hope is soon."

Netflix said it has paused most of its productions across the world in response to government lockdowns and guidance from local public health officials. "No one knows how long it will be until we can safely restart physical production in various countries, and, once we can, what international travel will be possible, and how negotiations for various resources (e.g., talent, stages, and post-production) will play out," it added. Source: Netflix statement

"Like other home entertainment services, we’re seeing temporarily higher viewing and increased membership growth," Netflix said. "In our case, this is offset by a sharply stronger US dollar, depressing our international revenue, resulting in revenue-as-forecast. We expect viewing to decline and membership growth to decelerate as home confinement ends, which we hope is soon."

Netflix said it has paused most of its productions across the world in response to government lockdowns and guidance from local public health officials. "No one knows how long it will be until we can safely restart physical production in various countries, and, once we can, what international travel will be possible, and how negotiations for various resources (e.g., talent, stages, and post-production) will play out," it added. Source: Netflix statement

North America Bolsters Ericsson

Ericsson reported a 2% year-on-year decline in sales on a comparable basis for the first quarter to 49.8 billion Swedish krona (4.94 billion US dollars).

"Underlying business fundamentals remain strong," said Börje Ekholm, Ericsson CEO. "With growth in data in general and with working from home as the new normal in many countries, good connectivity is more important than ever. For 2020, we estimate the RAN (radio access network) market to grow by 4%, however, for Q2 we expect somewhat lower than normal sequential sales growth, as there are uncertainties impacting short-term growth negatively. ...while we have seen no material effects so far on our demand situation, it is prudent to believe that the slowdown in the general economy may lead some operators to delay investment programmes." Source: Ericsson statement.

"Underlying business fundamentals remain strong," said Börje Ekholm, Ericsson CEO. "With growth in data in general and with working from home as the new normal in many countries, good connectivity is more important than ever. For 2020, we estimate the RAN (radio access network) market to grow by 4%, however, for Q2 we expect somewhat lower than normal sequential sales growth, as there are uncertainties impacting short-term growth negatively. ...while we have seen no material effects so far on our demand situation, it is prudent to believe that the slowdown in the general economy may lead some operators to delay investment programmes." Source: Ericsson statement.

Tuesday, April 21, 2020

Monday, April 20, 2020

The Broadband Decade: Who Won?

Pringle Media has just published a 60 page report tracking and comparing the key financial metrics of Deutsche Telekom, Orange, Telefónica, Telecom Italia and Vodafone over the past decade: Screen shots of eight sample pages below.

If you would like to purchase a PDF copy of the report, priced at 100 euros for a company-wide license, please send an email to pringled@btinternet.com

If you would like to purchase a PDF copy of the report, priced at 100 euros for a company-wide license, please send an email to pringled@btinternet.com

IDC: Telecoms Spending to be Flat in 2020

Spending on telecommunication services (including pay TV) will reach 1.6 trillion U.S. dollars in 2020, similar to the level in 2019, according to IDC. That represents a slight downgrade on its November 2019 forecast. At that time, the research firm anticipated that spending on telecom and pay TV services would reach 1.65 trillion dollars in 2020, up from 1.63 trillion in 2019.

Although the Covid-19 pandemic has increased home usage of telecom services, IDC warned this doesn't directly translate into a surge in telecom spending as many households have unlimited voice calls and unlimited Internet services. "COVID-19 is leading to a lot of uncertainty around the spending impact on various technology markets. We expect the telecom services market to weather the current conditions better than other elements of the ICT market," said Carrie MacGillivray of IDC. Source: IDC statement

Although the Covid-19 pandemic has increased home usage of telecom services, IDC warned this doesn't directly translate into a surge in telecom spending as many households have unlimited voice calls and unlimited Internet services. "COVID-19 is leading to a lot of uncertainty around the spending impact on various technology markets. We expect the telecom services market to weather the current conditions better than other elements of the ICT market," said Carrie MacGillivray of IDC. Source: IDC statement

Tuesday, April 7, 2020

Samsung Sees Sales Rising

Samsung Electronics expects to report sales of about 55 trillion Korean won (45.4 billion US dollars) for the first quarter of 2020. That would represent a year-on-year rise of 5%. It also expects to report a 3% rise in operating profit to 6.4 trillion won. source: Samsung statement

Subscribe to:

Posts (Atom)